[ad_2]

Stocks rose with oil amid optimism major crude producers will work to cut output and ease a supply glut. Mexico’s peso jumped on speculation Republican candidate Donald Trump’s performance in the second U.S. presidential debate wasn’t strong enough to boost his chances of winning.

Energy shares led gains in equities as crude jumped to a one-year high after Saudi Arabia said other oil exporters have expressed their readiness to cooperate on a deal and President Vladimir Putin affirmed that Russia would back an accord. Currencies of commodity-led nations rallied as the peso advanced the most among major peers, jumping almost 2 percent. U.K. 10-year gilt yields rose on concern the plunging pound will fuel inflation.

Tension in markets are ticking higher with the presidential election just four weeks away and the specter of higher U.S. borrowing costs before the year is out a constant in investors’ minds. A CNN poll awarded the second debate to Democratic nominee Hillary Clinton, with Trump’s campaign hit by a 2005 video in which he made vulgar and degrading comments about women. Crude also loomed large over Monday trade as ministers from some of the largest producers gathered in Turkey to discuss ways of ending the supply glut.

“The gains today could be because Putin has said that he’s willing to reduce output and freeze production,” said John Conlon, chief equity strategist at People’s United Wealth Management in Bridgeport, Connecticut, which oversees $5.5 billion. “The earnings season is now going to be grabbing attention for the next three weeks. Earnings are going to push the interest-rate and oil discussion aside.”

For more on the oil discussions in Istanbul, click here.

Global trading has gotten off to a rocky start in October amid speculation that the European Central Bank will start tapering stimulus and as hawkish comments from Federal Reserve officials boosted bets on a rate increase in 2016. Minutes from the U.S. central bank’s September meeting will be released on Wednesday, and data on retail sales, producer prices and consumer sentiment are due Friday. Investors are also seeking clues as to the health of corporate America, with Alcoa Inc. kicking off the next earnings season on Tuesday.

Stocks

The S&P 500 Index rose 0.5 percent to 2,163.66 as of 4 p.m. in New York, while MSCI’s gauges of global and emerging-market equities climbed with oil.

Exxon Mobil Corp. advanced to a one-month high, driving S&P 500 energy stocks to their highest point since July 17. Drugmaker Mylan NV surged after agreeing to pay $465 million to settle a probe over how it charged Medicaid for the allergy shot EpiPen. Twitter Inc. tumbled after potential bidders were said to have lost interest in making offers to buy the social-media company.

While analysts are forecasting a 1.6 percent contraction in third-quarter profits for S&P 500 companies, U.S. firms have exceeded projections by an average margin of 3.6 percentage points in the past five years, data compiled by Bloomberg show. Should the trend continue, it will likely result in earnings growth for the period.

Still, Goldman Sachs Group Inc. says both U.S. and European equities are in for a bumpy ride into the end of the year.

“We have more potential for shocks right now,” Christian Mueller-Glissmann, Goldman Sachs’s managing director of portfolio strategy and asset allocation, said by phone from London on Oct. 6. “We have a slight tilt to be a bit more defensive, and tilt towards Asia and emerging markets relative to more developed markets. We are a bit more bearish on Europe and the U.S into year-end.”

European stocks halted a three-day slide as the surge in crude propelled energy companies higher. Deutsche Bank AG rallied as Austria’s Finance Minister said the German lender should be able to “solve the problems with the United States” and that a fine of $10 billion would be too much. Vivendi SA climbed as Vincent Bollore’s investment company raised its stake in the French media conglomerate to more than 20 percent.

Asian index futures were mixed Monday, with markets in Japan and Hong Kong closed for holidays. Contracts on the Nikkei 225 Stock Average jumped 1 percent in Chicago, rising with futures on Australian and South Korean shares, while those on indexes in Hong Kong fell at least 0.2 percent in most recent trading.

Commodities

West Texas Intermediate oil for November delivery rose 3.1 percent to $51.35 a barrel on the New York Mercantile Exchange, the highest close since July 15, 2015. Brent for December settlement increased 2.3 percent to $53.14 a barrel on the London-based ICE Futures Europe exchange, its highest point since Aug. 31, 2015. The global benchmark closed at a $1.27 premium to WTI.

Many other oil producers have expressed their readiness to work with the Organization of Petroleum Exporting Countries on a production deal, Saudi Minister of Energy and Industry Khalid Al-Falih said in Istanbul, where he’s attending the World Energy Congress. He will meet in the next couple of days with his Russian counterpart, Alexander Novak, who said on Monday his country is ready for an accord with OPEC.

“This is a headline-driven situation, and will remain so as long as everyone is in Istanbul,” said Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York. “It was the Saudi statement that got us in positive territory and the Russian comments have added to the market’s strength.”

Gold futures rebounded from their biggest weekly drop in more than three years as data showed investors jumped into exchange-traded funds backed by the metal, lifting global holdings to the highest since 2013. Silver and copper also rallied, leaving the Bloomberg Commodity Index up 1.3 percent at its highest close since July.

Currencies

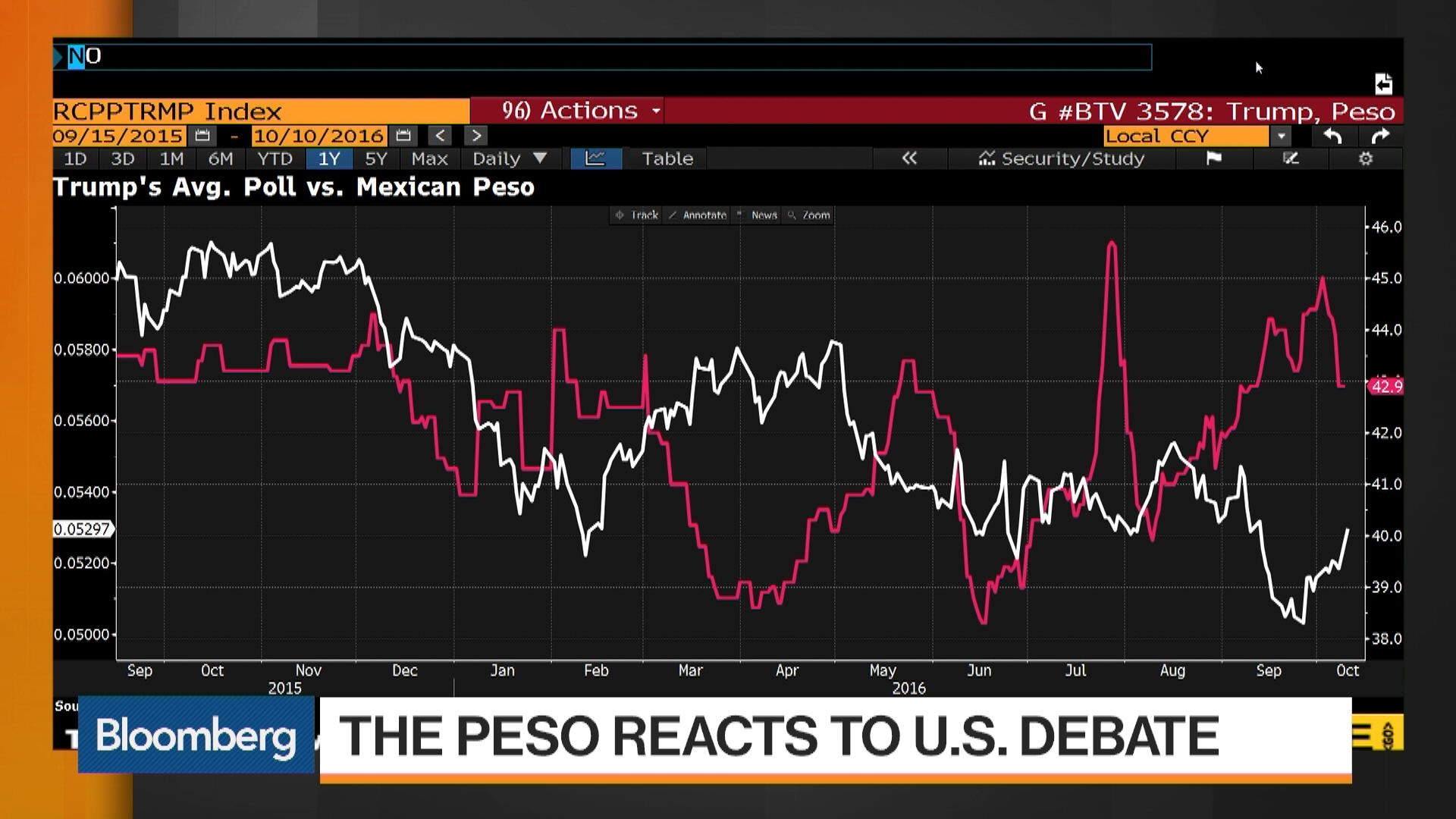

Mexico’s peso jumped as much as 2.6 percent Monday to a one-month high. The currency has been a barometer of investor anxiety over the U.S. election, weakening when Trump advances in polls and gaining when he is perceived as doing badly. The Republican nominee has pledged to renegotiate the North American Free Trade Agreement and deport undocumented immigrants.

“The market reaction has this takeaway that Trump’s campaign is struggling,” John Hardy, Saxo Bank’s head of foreign-exchange strategy, said in a Bloomberg Television interview from Hellerup, Denmark. “The market has seized upon this as trading the Mexican peso as some kind of financial market proxy for the political outcome of the election.”

Elsewhere, Canada’s dollar climbed the most since July while Russia’s ruble erased an earlier slide as crude rallied.

The yuan retreated the most in four months as Chinese markets resumed following a week-long break. The pound slumped for a third day as investors awaited clues as to whether Britain is headed for a so-called hard Brexit.

Bonds

Yields on 10-year British gilts extended their increase above 1 percent after surpassing that level last week for the first time since late June.

Portugal’s bonds climbed the most in three months after the country’s finance chief said that rating company DBRS Ltd. positively assessed the nation’s fiscal efforts, boosting the government’s conviction that it will retain the country’s investment-grade credit rating.

Saudi Arabia, which is undergoing its biggest economic overhaul in recent history, will start meeting investors this week with a view to selling its first international bond, according to people familiar with the matter.

Trading in Treasuries was halted on Monday for the Columbus Day holiday.

Let's block ads! (Why?)

[ad_1]

Source link

No comments:

Post a Comment